A savings account is a deposit account that generally earns higher interest than an interest-bearing checking account. Savings accounts limit the number of certain types of transfers or withdrawals you can make from the account each monthly statement cycle.

- Regular Savings Accounts: What are they and which are the best ones? A quick guide to regular savings accounts Some of the better rates available on cash savings at the moment come with the regular savers linked to bank current accounts, although there are also regular savings accounts paying decent rates that don’t require you to switch banks.

- Our most popular accounts Key features and fees Way2Save ® Savings. Great way to save automatically and build your savings. Minimum opening deposit. Save As You Go ® transfer option: We'll automatically transfer $1 of your funds from your linked Wells Fargo checking account to your Way2Save Savings account for each.

Regular savings accounts offer above-inflation interest rates, providing you stick to their rules. Here, we look at the best options for monthly savers.

Inflation is down to 2.4%, which means a handful of fixed-rate bonds can now beat it (read more about these here).

Yet for those of us that don't want to lock away our money for five years or more, there are only two ways to beat inflation with savings.

The first is high-interest current accounts, and the second is through regular savings accounts.

No traditional savings account even comes close to the 5% interest rates that the best regular savings account offers.

However, these accounts are often tied to other products and have various conditions attached - here's how to get started.

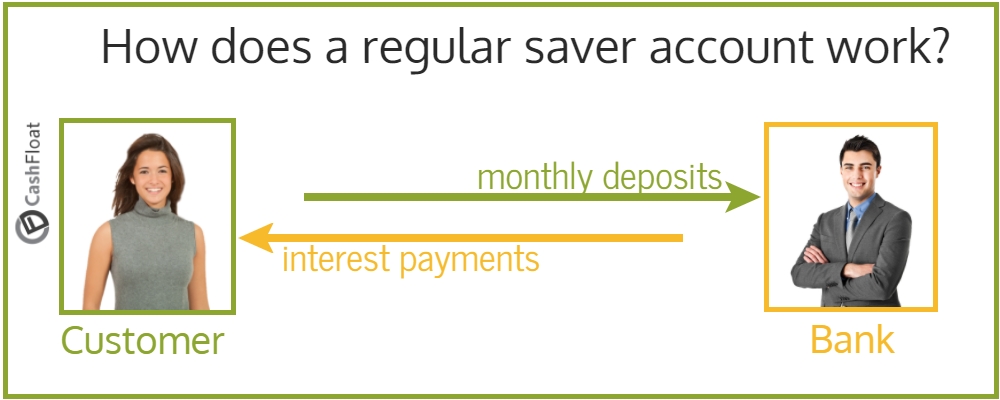

How regular savings accounts work

Regular savings accounts, as their name suggests, reward you for regularly saving into them. If you’re saving up for a big purchase or want to put some money away for the short term, they can be a good option.

Regular savings accounts still offer far better interest rates than instant access and short-term notice accounts.

But bear in mind that you need to be able to save money each month into a regular savings account to benefit from these better rates.

And most accounts will only allow you to save for a set period after opening, usually a year. If you withdraw money or close the account during that period, you'll get a much lower interest rate.

There are also restrictions in terms of the maximum amount you can save each month. If you have a lump sum to save, take a look at The top fixed rate savings bonds, or for tax-free savings The UK's best Cash ISAs.

You should also remember that because you’re putting a little aside each month, you won’t earn the same amount of interest over a year as you would if you deposited a lump sum. That’s because you won’t have the maximum amount saved away until the final month of the year.

Best Regular Savings Accounts

Let’s have a look at the top accounts on offer at the moment.

Best Regular Savings Account Ireland

Top accounts… with strings attached

The top-paying regular savings accounts at the moment are only available to existing customers of the banks or building societies offering them.

Account | Interest rate AER | Minimum monthly deposit | Maximum monthly/annual deposit | Minimum term | Need to know |

|---|---|---|---|---|---|

First Direct Regular Saver | 5% | £25 | £300/£3,600 | One year | Only available to first direct 1st Account customers. |

HSBC Regular Saver (Premier or Advance customers) | 5% | £25 | £250/£3,000 | One year | Only available to HSBC Premier or Advance customers. |

M&S Bank Monthly Saver | 5% | £25 | £250/£3,000 | One year | Only available to M&S Premium Current Account customers. |

Nationwide Flexclusive Regular Saver | 5% | £25 | £250/£3,000 | One year | Only available to Nationwide current account holders |

Santander Regular eSaver (for 1|2|3 customers) | 3% | £1 | £200/£3,000 | One year | Only available to Santander current account customers. |

| Club Lloyds Monthly Saver | 3% | £25 | £400/£4,800 | One year | Only available to Club Lloyds or Club Lloyds Added Value current account customers. |

HSBC Regular Saver | 3% | £25 | £250/£3,000 | One year | Only available to Bank Account, Bank Account Pay Monthly or Graduate Bank Account customers. |

While that might look restrictive, it’s worth bearing in mind that First Direct has consistently been voted one of the best banks for customer service. And the bank is currently offering a £150 travel voucher, gadgets or online courses if you switch your account to a 1st Account.

The top accounts with no penalties

If you want the option to have access to your cash, for example in an emergency, you would normally have to settle for a lower interest rate.

But the top rates in this category are better than more restricted accounts at the moment!

Account | Interest rate AER | Minimum monthly deposit | Maximum monthly/annual deposit | Minimum term | Access |

|---|---|---|---|---|---|

Saffron BS 12 Month Fixed Rate Members’ Regular Saver (Issue 3) | 3.5% | £10 | £200/£2,400 | One year | Branch, post |

| Santander Regular eSaver | 3% | £0 | £200 | One year | Online, in branch |

Kent Reliance BS One Year Regular Savings Account | 3% | £25 | £500/£6,000 | One year | Branch |

Virgin Money | 3% | £1 | £250/£3,000 | One year | Branch, post |

Savings Account With Most Interest

The top accounts with withdrawal penalties

Now let’s look at the best accounts that don’t require you to be an existing customer to qualify but do penalise you if you make withdrawals during your minimum term.

Account | Interest rate AER | Minimum monthly deposit | Maximum monthly/annual deposit | Minimum term | Need to know | Access |

|---|---|---|---|---|---|---|

Leeds Building Society Regular Saver | 2.30% | £50 | £250/£3,000 | One year | One withdrawal is permitted each Bonus period (from 1 September – 31 August each year). | Branch, post |

Interestingly the top accounts that penalise you for making withdrawals are actually less competitive than the best deals that are penalty-free.

The Financial Services Compensation Scheme

Finally, just a reminder that all the above regular savings accounts are covered by the Financial Services Compensation Scheme (FSCS).

Best Regular Savings Account Hsbc

This guarantees your savings up to £85,000 per bank or building society group (if you want to see who owns who, read Who owns your bank or building society?) in the event that they go under.

Best Regular Savings Account Rates

More on savings: